- The Money Toolkit

- Posts

- How To Build Generational Wealth

How To Build Generational Wealth

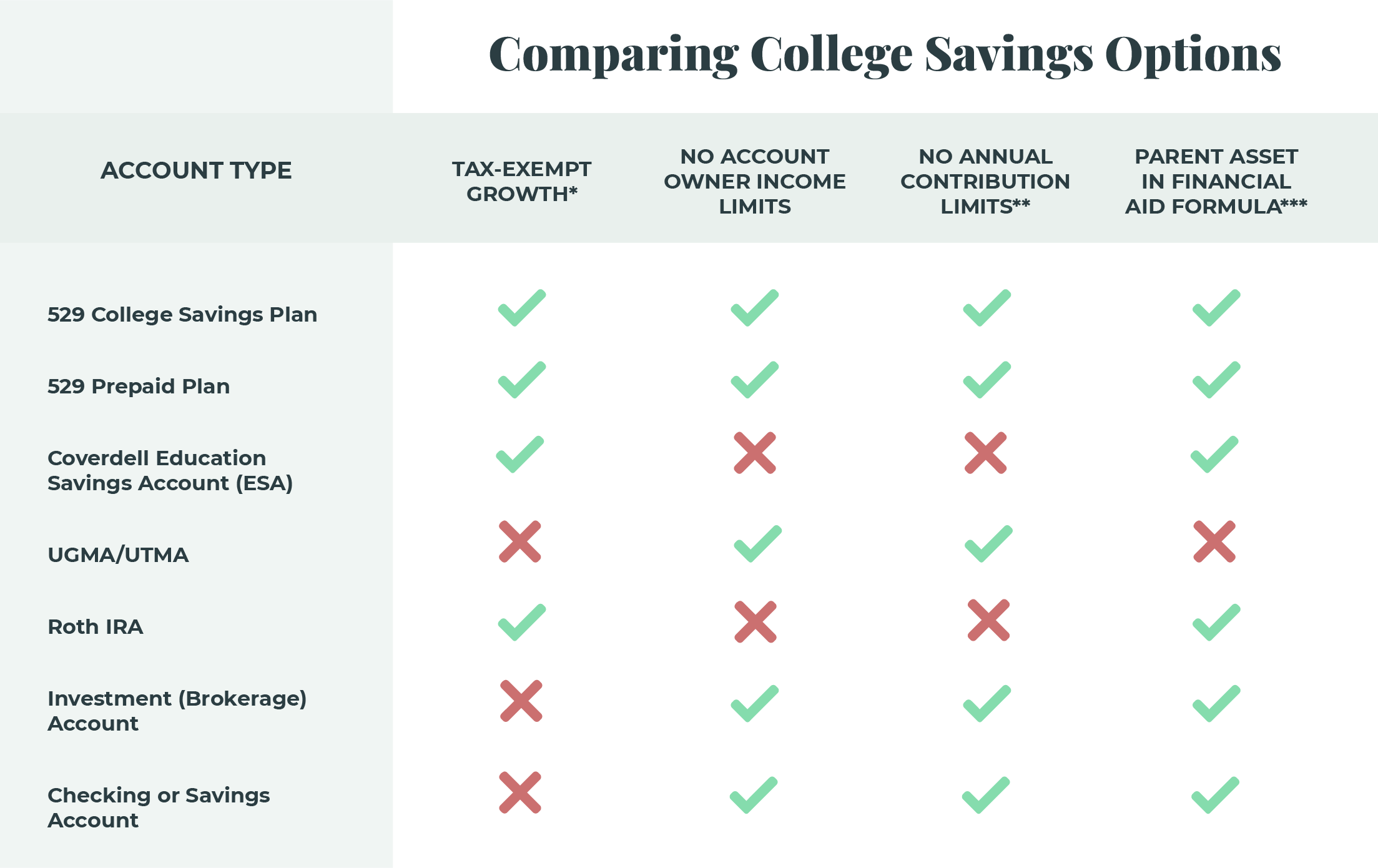

Comparing UTMA/UGMA, 529 and Custodial IRA Accounts

Build Generational Wealth

Presented by The Savings Captain

Comparing UTMA/UGMA, 529 and Roth IRA’s for Minors

Subsection 1 Title

Would your financial life have been easier if you had a head start? Money invested for you at a young age to pay for education or a stash invested to jumpstart a nest egg. Of course it would.

We can’t reverse time, but we can leverage it for the benefit of the next generation. Let’s get familiar with three types of accounts you can use to set the next generation up for financial success: UTMA/UGMA, 529’s, Custodial Roth IRA.

Subsection 2 Title

All three of these accounts are excellent choices. Like most things in investing it does not have to be one or the other, it could be a combination of all three, The most important thing to consider is what is the intent of the money

UGMA/UTMA accounts offer the most flexibility in terms of investments and use of funds, but have less favorable tax treatment and a higher impact on financial aid eligibility. At age 18/21 depending on state the money is the beneficiaries. Will they be mature enough to handle the largest sumo money they have probably ever seen?

529 plans provide excellent tax benefits for education savings and have a lower impact on financial aid, but are restricted to educational expenses. In 2024, the SECURE Act 2.0, now allows unused funds for education to be rolled over into a Roth IRA for the beneficiary. (Contribution limits and income qualifications apply)

Roth IRAs for minors offer tax-free growth and more flexibility than 529 plans, but require earned income and have lower contribution limits. Great for the self-employed or when a teen gets their first job. But for most you can’t start this until later in childhood

Setting your family up generational wealth can be a wonderful thing. As always make sure your financial situation is stable first. If it is help your kids or young ones in your family, small sums like $25 or $50 add up…and oh the power of compounding is phenomenal.

My call to action is see which account supports your goals the best. Get STARTED and change wealth for the next generation.

Check out the charts below….I have personally used all three and advised clients on this. Send me your questions or reach out to [email protected] for a straight answer.